Oil and gas giant to quit Australian renewables despite CIS battery tender win

French oil and gas giant TotalEnergies has confirmed its plans to quit its renewable energy assets in Australia and many other countries, despite its recent win in the federal government’s flagship Capacity Investment Scheme tender.

TotalEnergies this week held its capital markets day, where it announced it would sell its renewable energy assets in all countries except for the US, Brazil and Europe, as part of a plan to expand its core oil and gas operations.

The company says its “transition strategy” is now focused on two pillars – oil and gas – and it expects to boost earrings by 70 per cent by 2030 by focusing on LNG expansion, and intends to return nearly half of its cash flow to shareholders through dividends and buybacks.

“We need more flexible assets and less renewables,” Total CEO Patrick Pouyanne said. “It is not a priority of the company to be a pure renewable developer … we are not a renewable developer.

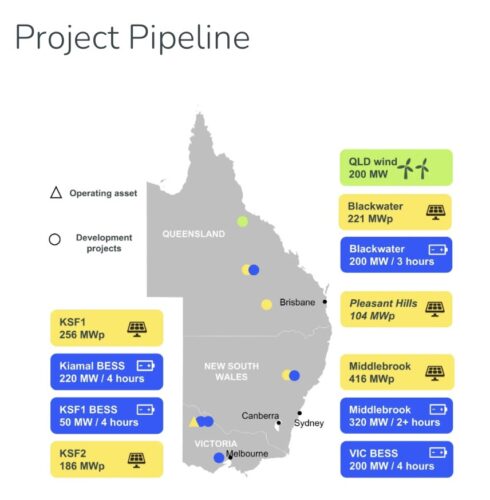

Total had already started the sale process for its Australian renewables and storage business, which comprises more than 2.3 GW of projects, including the operating 265 MW Kiamal solar farm in Victoria, and the Kiamal battery that was last month announced as one of 16 winners of the country’s biggest ever battery tender.

That Kiamal battery project is sized at 220 MW and 810 MWh, and under the CIS tender agreement needs to be operational by the end of 2029.

The Kiamal battery is intended to store solar from the existing solar farm, which was the first in the world to build a synchronous condenser to help solve system strength issues in part of a grid known as the “rhombus of regret.” Total has also planned a 150 MW extension to the Kiamal solar project.

Other projects in its Australian portfolio include the proposed Middlebrook solar project and battery in NSW, the Blackwater solar farm and battery in Queensland, the Pheasants Hills solar project in Queensland, and an unnamed wind project in Queensland.

The proposed exit of Total from the Australian renewable sector – it retains several significant LNG investments – follows the example of other oil and gas giants including bp, Shell and Norways Statkraft, who are all looking to sell local assets as their HQs focus their attention on fossil fuel developments.

It was reported earlier this year that Azure Capital has been mandated by Total to run Project Canele, the name given to the sales process for its Australian renewable and storage portfolio.

Pouyanne said the group will still achieve its long-standing goal of 100GW of gross power capacity for 2030, but that will now include 20GW of batteries and ‘flexible’ generation based around gas.

Total said it may keep some renewable investments in India and South Africa. “We want to divest all the other countries,” said Total’s president of gas, renewables and power Stephane Michel, according to Recharge. Total did not respond to questions from Renew Economy.

More information:https://reneweconomy.com.au/oil-and-gas-giant-to-quit-australian-renewables-despite-cis-battery-tender-win/