A massive week for battery storage, but where are the financiers for wind and solar?

It had all the makings of a great week for the renewables energy industry – a huge boost to the government’s flagship policy mechanism, confirmation that wind, solar and storage are Australia’s lowest cost option to replace its ageing coal generators, news of a growing pipeline of projects and some landmark battery deals.

But all is not as it seems. There is still not enough financial fuel in the tank to get new projects across the line – unless they are big batteries. All eyes are on Tim Nelson and his panel to see if he can find a solution to the “tail risk” problems that have kept banking wallets shut, and projects stuck at the departure gate.

Energy minister Chris Bowen kicked off the week by announcing a 25 per cent boost to the Capacity Investment Scheme, now seeking 40 gigawatts of new capacity rather than 32 GW. The CSIRO followed it up with its latest GenCost report, underlining the huge cost advantage of integrated wind, solar and storage to decarbonise the country’s grid.

The Australian Energy Market Operator reported on record levels of project commissioning, project connections and project pipelines, and NSW energy minister Penny Sharpe announced a new tender for 500 MW of firming capacity.

Australia’s biggest coal generator AGL then capped it off by announcing it had reached financial close on its biggest ever battery, a 2,000 MWh giant to be built next to the Tomago aluminium smelter.

So, all is good then? Well, not quite.

BloombergNEF’s Leonard Quong punctured the mood of the Australian Clean Energy Summit (ACES) in Sydney this week when he brought home the grim reality that new projects are getting hard to shift. Or, at least, they are getting hard to finance.

“I don’t like giving depressing presentations,” Quong said, before working through some of the big issues around the world of green energy, which despite some $2.8 trillion in new investment in 2024 is facing problems with global supply chains, the Trump’s administration’s war on climate and green energy, and its tariffs on China.

But the biggest blow for Australia’s ambition was a graph illustrating the rate of financial close (FID) for wind and solar projects in Australia in the first six months of 2025. There was zero for wind, and not much for solar.

How is this possible?

In the corridors of ACES, multiple reasons were being offered. The delay in grid infrastructure and new transmission projects features prominently, so too does the impact of the wait for auction results on grid access in NSW, and the bastardry against green energy of the new state LNP government in Queensland.

But there are other factors too: No none is yet convinced in Victoria that Yallourn really will close in 2028, as advertised, although if there is no new investment in bulk green energy, then it might become a self-fulfilling prophecy.

And while the CIS has already granted underwriting agreements to 19 new wind and solar projects, only one has begun construction. Many of the others, analysts say, failed to lock in any off-take agreements while waiting for the CIS outcome, and now find it difficult to land a contract given the market has moved, and corporate buyers have disappeared.

Only Rio Tinto – anxious to build new capacity to power its massive smelters and refineries – seems to be interested in signing contracts for new wind and solar projects. The CIS underwriting agreement provides a base, but not yet enough, it seems, to get projects over that financing hurdle.

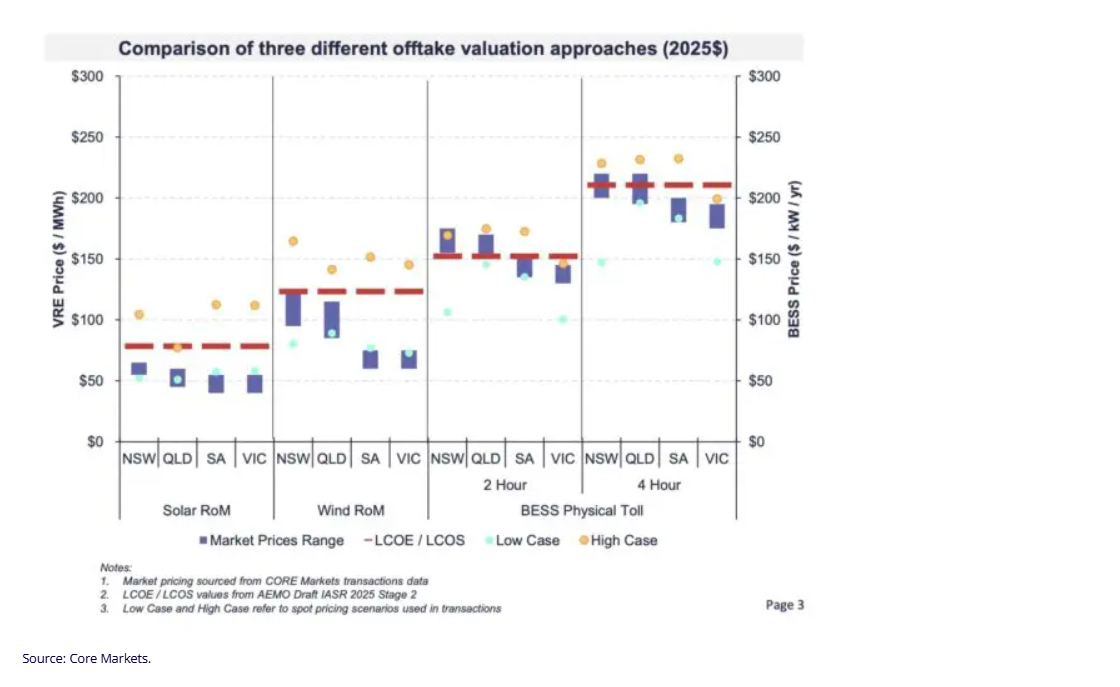

Alan Rai, from Core Markets, gave an interesting presentation that shed some light on the problem. Basically, the contracts on offer are at pitched at less than the cost of the technology itself.

The graph above shows the current LCOE (levelised cost of electricity) for both solar and wind (the thick red dotted lines) and the blue rectangles below indicate the off-take prices being offered by potential customers. It is not enough to get them across the line.

“You can see the gap is really great with solar, where market pricing is lower, and the off-take market pricing is lower than project break-evens,” Rai said at his presentation at ACES. “That’s true also for wind in Victoria and South Australia.”

It’s not so bad for battery storage, where off-takes are above the water, particularly in NSW and Queensland. And it’s the combination of these technologies that will likely deliver a solution. There are now virtually no new solar projects without a battery attached, and wind project developers are now following down the same track.

BNEF’s Quong put it this way.

“If you look at the realised, the captured prices for generation assets across the NEM, we can see that the value of solar and wind is beginning to fall now, to $20, $40, $60, or even $100 per megawatt hour less than the average around the clock wholesale price in these markets.”

And Quong also noted the issues with power grids, with delays and cost blowouts. “Power grids, too, are representing a challenge for the industry,” he says.

“This isn’t just an Australian phenomenon. We’re tracking over one terawatt of wind and solar assets across the world stuck in interconnector queues that is waiting for grid connection approval, but we think Australia might be particularly susceptible to this.

“Our abundance of land gives us an advantage in having a high number of high quality wind and solar resources, but the tyranny of distance still reigns in this high-cost environment.

“We need to continue to build out the grid infrastructure required to ensure that supply from these new clean sources can reach demand.

“And with all these challenges, with all these obstacles, it might not surprise anyone to know that investment in new large scale renewable assets in the country is falling not off the cliff, but to levels slightly above the minimum we’ve seen on the past six years, and certainly not on the trajectory required to reach Australia’s decarbonisation goals.”

So, what’s the solution? Rai suggests that the market wants to hear, unequivocally, from Victoria that Yallourn will not be extended. And while the federal government expands the CIS capacity, it may need to find a way to deliver more support.

The anticipated release of the initial findings of the Nelson Review, expected in the next week or so, could provide an answer, and the basis of a long-term price signal for the market.

More information: https://reneweconomy.com.au/a-massive-week-for-battery-storage-but-where-are-the-investors-in-wind-and-solar/